Healthcare in the crosshairs

"Battering insurers, including one of my holdings - Molina Healthcare (MOH)."

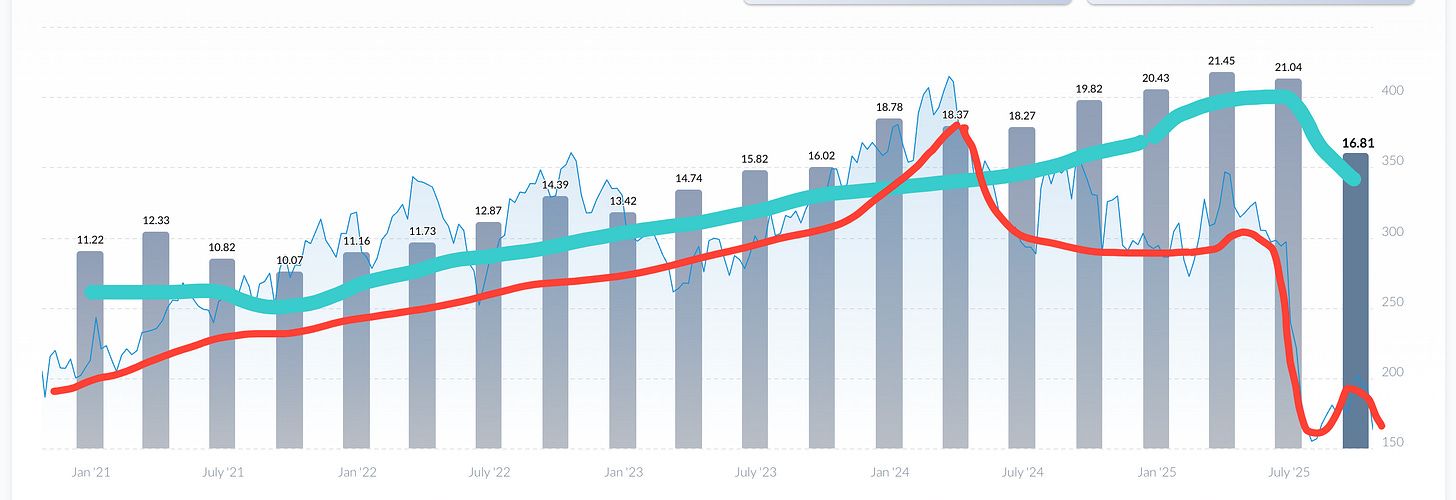

Hi all. This week, the White House dialed up its rhetoric against the US healthcare system. Openly floating the idea of sending healthcare payments directly to patients. The move would mean bypassing insurers and programs like Medicare and Medicaid altogether. Rendering them rather obsolete. And it would put the entire health insurance industry squarely in government crosshairs. It was quite a brainstorm. Shockwaves And it naturally sent shockwaves through the market. Battering insurers, includi

Painful 20% drop for Molina Healthcare (again). My stock buy of the week

"Summary Molina Healthcare (MOH) dropped 20% Thursday Disappointing earnings, for sure But the market knew things were grim Defensive value story still intact Just ask Berkshire Read on. UnitedHealth (UNH), Centene (CNC), Elevance (ELV), and Molina. And how Buffett swooped in and snatched UNH after the big sell-off."

Hi all, hope you’re enjoying earnings season. For quarterly reports, I’m of two minds: good that companies offer a quick snapshot of how things are going crazy how much markets can react to this snapshot But when markets act crazy, there’s opportunity. This season is no different. Summary Molina Healthcare (MOH) dropped 20% Thursday Disappointing earnings, for sure But the market knew things were grim Defensive value story still intact Just ask Berkshire Read on. What were you